Eligible Collateral Representation

Introduction

Within collateral documentation, it is common to detail what assets you will exchange with your counterparties, i.e., what you deem eligible collateral. Such information is found in bilateral legal documents, custodian triparty agreements, and is also used for other purposes where defining whether an asset is eligible to be used as collateral to mitigate risk on a defined set (portfolio) of financial instruments between parties.

Data requirements to represent eligible collateral include common information such as asset descriptors e.g. who issues the asset, the asset type, its maturity profile, any related agency credit risk rating, and if any collateral haircut is to be applied to the asset's value.

Within legal collateral documents, the definition of eligible collateral can take several forms; some may want to list assets and the related eligibility information in table-format using common language, use textual description of types of eligible assets, or use common identifiers and taxonomies. However, it is evident for each method chosen there is no common data standard to express the same information for all the data attributes used.

The financial crisis and the resulting regulatory framework that emerged from guidelines outlined under BCBS/IOSCO and Basel III has presented further requirements that define specific criteria for collateral eligibility that must be applied to portfolios. Observation of different regulations under various jurisdictions has presented several challenges for defining collateral asset economic identity, correct categorisation, and application of specified haircuts and concentration limits. Having no common standards in place to represent the key data has led to lengthy negotiation, misinterpretation, lack of interoperability, and downstream operational inefficiency.

Eligible Collateral in the CDM

The CDM provides a standard digital representation of the data required to express collateral eligibility for purposes such as representation in legal agreements that govern transactions and workflows. The benefits of this digital representation are summarized below:

- Provides a comprehensive digital representation to support the data requirements to universally identify collateral types.

- Includes ability to identify attributes of collateral that contribute to the risk like the type of asset, interest structures, economics, embedded options and unique characteristics.

- Provides the capability for these attributes to be combined using AND, OR, and NOT logic operators to enable complex representations of the interactions between attributes to digitise the rules around eligibility.

- Uses data standards to specify eligibility related information such as haircuts (regulatory credit quality, FX related or additional haircuts), agency or composite credit ratings and asset maturity terms.

- Provides functions to apply treatment rules to predefined collateral criteria such as include/exclude logic.

- Applies treatment rules for concentration limit caps by percentage or value. These can be applied to one or multiple elements of the collateral characteristics and defined criteria.

- Includes attributes to identify regulatory rules by defined eligibility identification categories published by regulatory bodies such as EMIR, CFTC and US Prudential.

- Provides a means of identifying schedules and constructing reusable collateral profiles.

- Standardises digital data representation components to construct the details to identify collateral eligibility not just for regulatory purposes but for all needs of eligibility expression within legal contracts and documentation.

- Promotes a standard format to represent eligible collateral for negotiators to identify and agree details without misinterpretation.

- Provides standards to facilitate Interoperability between platforms for digitised eligible collateral information.

- Connects contractual terms of eligibility in documentation to supporting processes.

- Standardises data records for audit requirements.

- Provides many opportunities in the collateral ecosystem and benefits a data representation of collateral choices that can be imported and exported to other systems such as credit, treasury, trade reporting and custodian platforms, providing a full workflow solution from negotiation, execution through to optimisation and settlement.

Modelling Approach

Scope

The model's primary intention is to deliver standards for OTC Derivatives with a focus on uncleared margin rules. In addition, the approach is intended to also be used to express collateral eligibility for other industry workflows such as Securities Lending, Repo, and Exchange Traded Derivatives (ETD). The model foundations, broad range of attributes, and functions have been constructed with this in mind and can be extended further to operate to wider processes.

The common data requirements have been established through industry working groups reviewing a wide range of examples in order to identify collateral for the purpose of constructing eligible collateral specifications, including representation of additional attributes, for regulatory risk and credit factors. For the purpose of understanding the principle, these can be divided into the following categories:

- Issuer Identification

- Asset Identification

- Collateral Haircuts

- Maturity Ranges

- Concentrations Limits

- Treatments Functions

The data attributes within the model provide the flexibility to firstly identify the collateral issuer and asset class, then define its maturity if relevant, then apply treatment rules for any chosen haircut percentages, concentration limits and inclusion or exclusion conditions. The combination of these terms allows a wide range of collateral and associated data for eligibility to be represented.

Approach to identifying Collateral Assets

The universe of collateral used throughout the industry for risk mitigation purposes is vast and the intention is for the CDM to provide a standard means of identifying as much of this collateral universe as possible initially and then extend the model further as required via open-source contributions under the CDM governance structure.

At the outset, there have been no common standards for describing collateral; the foundational structure in the CDM provides a means to identify a majority of collateral issuers and covers a wide range of asset types that are commonly seen in eligible collateral data.

The approach in the CDM is to adopt a similar method to the 'Animal Kingdom' tree and taxonomy (kingdom → phylum → class → order→ family → genus → species), that is there is one method for describing any of the core attributes of an "animal" (i.e. type of issuer/type of asset/type of economic terms) that need to be referenced, but only one way. Each issuer type, asset type, economic type etc has a unique place in the universe of collateral but is logically grouped together with similar types.

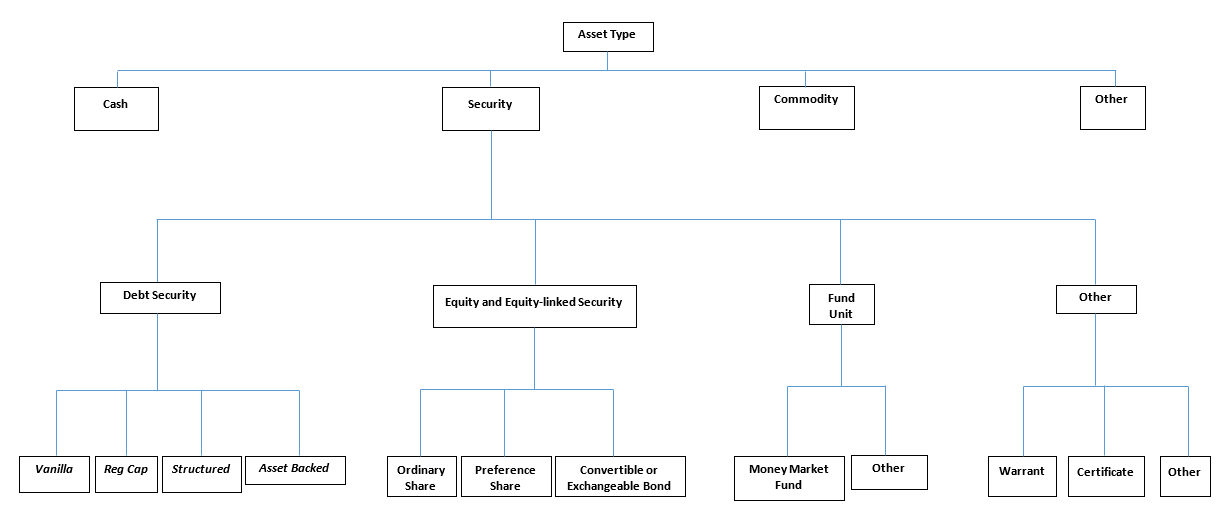

An illustrative example for understanding the principle is shown here:

The CDM method for representing eligible collateral will be capable of reference to, and inclusion in, common master and respective collateral documentation for OTC Derivatives and non-OTC master agreements (notably Repo and Securities Lending) and potentially for OTC Cleared and Exchange Traded Derivatives. For this reason, it is important that the CDM is able to accommodate Regulatory Uncleared Margin Rules concepts that are relevant but the model should not prescribed by them.

Although the industry will benefit from using a digital standard to describe collateral, there is also a need to recognise that market participants may want to identify eligible collateral without fully describing every feature and instead use industry identifiers, where available. Thus, the CDM also provides a means that collateral issuers can be identified using common legal entity identifiers such as an LEI. Similarly, asset types can be identified using a product ID such as ISIN or CUSIP or a standard taxonomy source.

High Level Design Principles

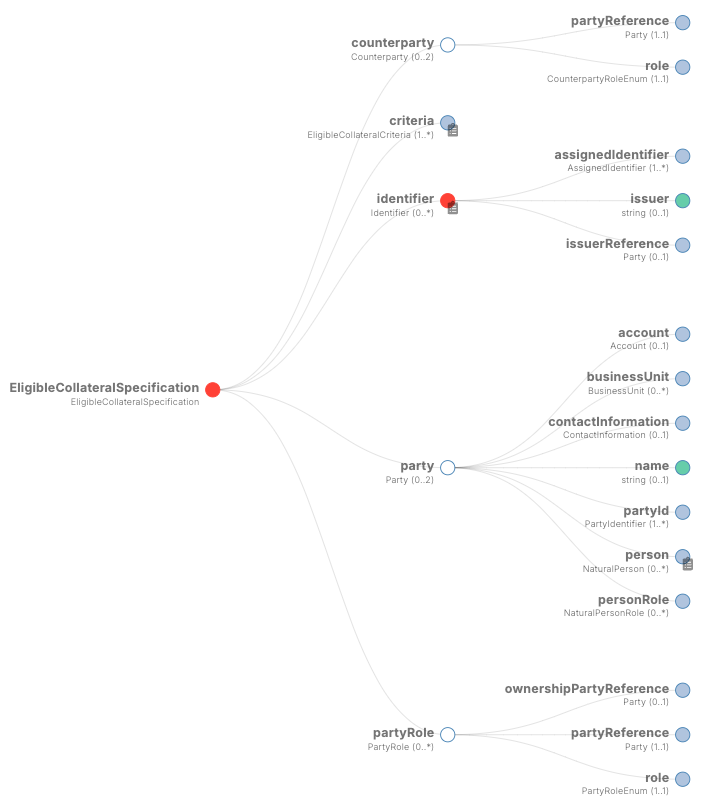

The highest level and foundational data structure for the representation of

eligibility is the EligibleCollateralSpecification which is a root class.

An EligibleCollateralSpecification typically represents

the schedule of eligible collateral agreed between two parties and is represented

digitally as one or more EligibleCollateralCriteria to define the details.

EligibleCollateralSpecification consists of the following key attributes:

-

The

identifierattribute is used to specify the identifier(s) that uniquely identify eligible collateral or a set of eligible collateral, such as a schedule or equivalant for an identity issuer. -

The

criteriaattribute is used to specify the set of criteria used to define eligible collateral, made up of one or moreEligibleCollateralCriteria. -

The

partyattribute is used to represent the parties to the agreement. -

The

partyRoleattribute is used to specify the role(s) that each of the party(s) is playing in the context of the specification, eg Payor or Receiver of collateral. -

The

counterpartyattribute defines the parties to the agreement in the form of references to the terms "Party1" and "Party2.

EligibleCollateralCriteria consists of the following attributes:

-

The

collateralCriteriaattribute is used to specify all of the criteria terms; this is discussed in more detail in the next section. -

The

treatmentattribute is used to specify the valuation percentage, any concentration limits and or specific inclusion or exclusion conditions, which additionally apply to filter whether a piece of collateral is eligible or not. -

The

appliesToattribute is used to specify which of the two counterparties the criteria applies to (either one or both counterparties). -

The

restrictToattribute can be used to restrict the criteria to only apply to a specific type of margin, i.e. IM or VM. -

The

ratingPriorityResolutionattribute denotes which Criteria has priority if more than one agency rating applies.

The combination of these terms allows a wide variety of eligible collateral types to be represented and a structure can be used to identify individual collateral types or a group of collateral assets for inclusion in specifying eligible collateral schedule details.

Identifying Eligible Collateral

A combination of data types can be used to describe the collateral

asset, its origin and its issuer. Data type EligibleCollateralCriteria

inherits attributes from CollateralCriteriaBase which contains data types to

define collateral Asset and Issuer characteristics.

CollateralCriteria

The data type CollateralCriteria is used to specify the definition of the

collateral terms. This data type is implemented as choice which means that, in

its simplest form, a CollateralCriteria can only

consist of a single collateral term. But terms can also be combined, using

AND and OR logic, which is covered in the next section.

The terms are modelled as individual attributes on the CollateralCriteria

choice data type:

choice CollateralCriteria: <"The possible different terms that can be combined, using AND, OR and NOT logic, to define the issuers and/or assets that meet a given criteria for collateral.">

AllCriteria <"Enables two or more Collateral Criteria to be combined using AND logic.">

AnyCriteria <"Enables two or more Collateral Criteria to be combined using OR logic.">

NegativeCriteria <"Enables a single Collateral Criteria to be excluded using NOT logic.">

CollateralIssuerType <"Criteria is the type of entity issuing the asset.">

CollateralGuarantorType <"Criteria is the type of entity guaranteeing the asset.">

AssetType <"Criteria is the asset type of the collateral.">

IssuerCountryOfOrigin <"Criteria is the issuing entity country of origin.">

AssetCountryOfOrigin <"Criteria is the collateral asset country of origin.">

CurrencyCodeEnum <"Criteria is the denominated currency of the collateral.">

IssuerName <"Criteria is a specific named issuer entity.">

IssuerAgencyRating <"Criteria is the agency rating(s) of the issuer.">

SovereignAgencyRating <"Criteria is the agency rating(s) of the country of the issuer.">

AssetAgencyRating <"Criteria is the agency rating(s) of the collateral asset.">

AssetMaturity <"Criteria is the maturity characteristics of the collateral asset.">

SpecificAsset <"Criteria is a specifically identified asset">

CollateralTaxonomy <"Criteria is the taxonomy characteristics of an collateral.">

ListingExchange <"Criteria is that the collateral is listed on a specific exchange.">

ListingSector <"Criteria is the industry sector of the collateral asset.">

IndexType <"Criteria is that the collateral is a constituent of a specific index.">

CounterpartyOwnIssuePermitted <"Criteria includes collateral issued by the counterparty.">

DomesticCurrencyIssued <"Criteria is that collateral must be denominated in the domestic currency of the issuer.">

Combining CollateralCriteria using AND and OR logic

The above code snippet only allows a single term to be specified within

the CollateralCriteria - i.e. the choice of one attribute.

In reality, it is usually necessary to combine terms together to model the eligiblity schedule fully. Furthermore, these combinations often need to use complex AND and OR logic between the terms.

For example, a schedule may specify that either of the following would qualify as eligible collateral:

- Equity assets from US issuers

- Bond instruments from UK issuers.

This can be described logically as:

( AssetType = 'Security' and SecurityType = 'Equity' AND IssuerCountryOfOrigin = 'USA')

OR

( AssetType = 'Security' and SecurityType = 'Debt' AND IssuerCountryOfOrigin = 'UK').

Within the CDM, the implementation of this AND and OR logic is achieved

by the addition of further attributes to CollateralCriteria:

AllCriteria: Enables two or more Collateral Criteria to be combined using AND logic.AnyCriteria: Enables two or more Collateral Criteria to be combined using OR logic.NegativeCriteria: Enables a single Collateral Criteria to be excluded using NOT logic.

For completeness, these additional types are modelled like this:

choice CollateralCriteria:

AllCriteria

AnyCriteria

NegativeCriteria

type AllCriteria:

allCriteria CollateralCriteria (2..*)

type AnyCriteria:

anyCriteria CollateralCriteria (2..*)

type NegativeCriteria:

negativeCriteria CollateralCriteria (1..1)

Treatment Functions

Treatment rules can be applied to eligible collateral in several ways

using data type CollateralTreatment which specifies the treatment

terms for the eligible collateral criteria specified . This includes a

number of options which are listed below:

valuationTreatmentSpecification of the valuation treatment for the specified collateral, such as haircuts percentages.concentrationLimitSpecification of concentration limits applicable to the collateral criteria.isIncludedA boolean attribute to specify whether collateral criteria are inclusion (True) or exclusion (False) criteria.

The CDM model is flexible so that these treatment rules can be applied to the detail of data expression for eligible collateral on an individual basis or across a group of issuer names or asset types or combinations of both. Each treatment function will have its own set of options and the model will provide further options of granularity.

Valuation Treatments

CollateralValuationTreatment will allow for representation of

different types of haircuts, as follows. Please note: data expression

for percentages is a decimal number between 0 and 1.

haircutPercentageSpecifies a haircut percentage to be applied to the value of asset and used as a discount factor to the value of the collateral asset, expressed as a percentage in decimal terms.marginPercentageSpecifies a percentage value of transaction needing to be posted as collateral expressed as a valuation.fxHaircutPercentageSpecifies an FX haircut applied to a specific asset which is agreed between the parties.AdditionalHaircutPercentageSpecifies a percentage value of any additional haircut to be applied to a collateral asset, the percentage value is expressed as the discount haircut to the value of the collateral.

Concentration Limits

ConcentrationLimit is another form of treatment which has a set of

attributes which allow concentration limits to be defined in two

alternative ways using ConcentrationLimitCriteria.

Generic method : If you wish to apply a concentration limit to a set

of pre-defined eligible collateral details in the CDM, you would use

ConcentrationLimitType, ConcentrationLimitTypeEnum which allows you

to define which existing details to apply the concentration limit to

from an enumeration list including (Asset, Base currency, Issuer,

Primary Exchange, Sector, etc).

Specific method : If you wish to apply a concentration limit to a

specific asset or issuer of asset, you would use the

ConcentrationLimitCriteria. This extends CollateralCriteriaBase and

allows you be more specific using the granular structures of CollateralCriteria

to specify the details of the terms you want to apply the concentration limit.

In addition, you would need to specify the form of the concentration limit being used as a value limit range to apply a cap (upper bound) or floor (lower bound) to the identified asset, issuer or attributes. There are two options that allow this to be represented in value or percentage terms as follows:

type ConcentrationLimit:

concentrationLimitCriteria ConcentrationLimitCriteria (0..1)

valueLimit MoneyRange (0..1)

percentageLimit NumberRange (0..1)

valueLimitSpecifies the value of collateral limit represented as a rangepercentageLimitSpecifies the percentage of collateral limit represented as a decimal number.

There are conditions in the CDM when applying concentration limits that constrain choices to:

- one of the concentration limit methods (either a limit type or limit criteria must be specified)

- one concentration limit type (either a value limit or percentage limit concentration must be specified).

Additional Granular Construction

The CDM data structure to express collateral eligibility has been

explored in more detail and it has been demonstrated where the

EligibleCollateralCriteria can be broken down into data related to

CollateralCriteria and rules can be applied using data

for CollateralTreatment.

The following section focuses on the more granular details of the

various data attributes available through CollateralCriteria.

Collateral Asset and Issuer Types

Under data type CollateralCriteria,

the CollateralIssuerType and AssetType attributes provide additional

data to detail collateral.

Defining Collateral Issuers:

CollateralIssuerType allows for multiple expressions of data related to the

issuer containing data attributes as

follows:

-

issuerTypeof typeCollateralEntityTypeEnumspecifies the origin of entity issuing the collateral with the following enumerations shown as examples but not limited to:- SupraNational

- SovereignCentralBank

- RegionalGovernment

- Corporate

Some attributes are extended to allow further granularity as shown in the examples below:

-

supraNationalTypeRepresents types of supranational entity issuing the asset, such as international organisations and multilateral banks -- with enumerations to define:- InternationalOrganisation

- MultilateralBank

Defining Collateral Guarantors:

CollateralGuarantor allows for multiple expressions of data related to the

guarantor containing data attributes as

follows:

guarantorTypeof typeCollateralEntityTypeEnumspecifies the origin of entity guaranteeing the collateral.

Defining Collateral Assets:

AssetType - Represents the type of collateral asset with data attributes

as enumerations to define:

-

Security

-

Cash

-

Commodity

-

Other Collateral Products

-

securityType- Represents the type of security with data attributes to define, as examples:- Debt

- Equity

- Fund

- Warrant

- Certificate

-

debtType- Represents a filter based on the type of bond which includes further optional granularity for certain characteristics that may be required to define specific details related to debt type assets such but not limited to as follows:- DebtEconomics

- Seniority

- Secured

- Senior

- Subordinated

- Interest

- Fixed

- Floating

- Inflation Linked

- Principal

- Bullet

- Callable

- Puttable

- Amortising

- Secured

- Secured Type

- Asset Backed

- Collateralized Obligation

- Covered Bond

- Property Type

- Redemption

- Redemption Type

- Put Call

- Party

- Seniority

- DebtEconomics

Mortgage Backed Securities can be represented as an Asset Backed security and by specifying the type of Asset as Mortgage. If required, users can also set the underlying property type.

A similar structure exists for equityType and fundType and other

collateral assets types.

As well as defining the details of the asset and issuer of collateral using the various attributes available in the CDM description tree, there are other detailed criteria that may be required to define collateral and for use in expressing eligibility details; the guide will detail these and indicate the data structure available to define them.

Agency Ratings Criteria

The use of specifying agency rating criteria for credit purposes can be useful for many means in legal documentation to drive operational outcomes such as collateral thresholds and event triggers. When defining collateral eligibility, the CDM can represent collateral underlying credit default risk in various ways by using agency rating sources. These are useful and common for determining eligible collateral between parties and those defined under regulatory rules for posting certain margin types.

The model components are specified in the CDM using the data types

IssuerAgencyRating, SovereignAgencyRating and AssetAgencyRating.

Each of these attributes on CollateralCriteria refer to the data type

AgencyRatingCriteria which allows specification of the following

related information to eligible collateral:

type AgencyRatingCriteria:

creditNotation CreditNotation (1..1)

mismatchResolution CreditNotationMismatchResolutionEnum (0..1)

referenceAgency CreditRatingAgencyEnum (0..1)

boundary CreditNotationBoundaryEnum (0..1)

qualifierIndicator for whether all or any of the agency ratings specified apply using the All or Any enumeration contained within QuantifierEnumcreditNotationIndicates the agency rating criteria specified for the asset or issuer. This expands to offer further granularity for details relating to the credit details

type CreditNotation:

agency CreditRatingAgencyEnum (1..1)

notation string (1..1)

[metadata scheme]

scale string (0..1)

[metadata scheme]

debt CreditRatingDebt (0..1)

outlook CreditRatingOutlookEnum (0..1)

creditWatch CreditRatingCreditWatchEnum (0..1)

CreditRatingAgencyEnumA list of enumerated values to specify the rating agency or agencies, (all major rating agencies are supported)notationSpecifies the credit rating notation. As it varies among credit rating agencies, the CDM does not currently specify each specific rating listed by each agency. The data 'string' allows the free format field to be populated with a rating , such as 'AAA'scaleSpecifies the credit rating scale, with a typical distinction between short term, long term. The data 'string' allows the free format field to be populated with a scale indicator such as 'long term', 'short term'.debtSpecifies the credit rating debt type is for any credit notation associated debt related credit attributes if needed. This gives the additional flexibility option to identify amongst the credit criteria debt characteristics such as (high yield, deposits, investments grade) The data type extends to offer two optionsdebtTypeThis attribute is free format 'string' and used when only one debt type is specifieddebtTypesThis allows you to specify multiple debt type characteristics and has a qualifying condition to specify if you wish to include 'All' or 'Any' of the elements listed in scope

outlookThis data attribute allows you to specify a credit rating outlook assessment that is commonly determined by rating agencies. It is an indication of the potential direction of a long-term credit rating over the intermediate term, which is generally up to two years for investment grade and generally up to one year for speculative grade. The enumeration list allows you to specify if required one of the following outlook terminology- Positive (A rating may be raised)

- Negative (A rating may be lowered)

- Stable (A rating is not likely to change)

- Developing (A rating may be raised, lowered, or affirmed)

creditWatchSimilar to detailing a type of credit outlook, credit agencies will also identify individual credit by a means of a monitoring (watch) status for an undefined period. This watch status can be expressed using the following data terminology under this enumeration list.- Positive (A rating may be raised)

- Negative (A rating may be lowered)

- Developing (A rating may be raised, lowered, or affirmed)

mismatchResolutionIf several agency issue ratings are being specified that are not necessarily equivalent of each, this data attribute allows you to label which one has certain characteristics amongst the others, such as lowest or highest etc, the following enumerations are available:- Lowest

- Highest

- Reference Agency

- Average

- Second Best

enum CreditNotationMismatchResolutionEnum:

Lowest

Highest

ReferenceAgency

Average

SecondBest

referenceAgencyThis part of the agency rating criteria again allows you to specify from the list of enumerated values for the rating agency. But in this case it is to identify the rating agency if you need to determine one from others if you used the data attributereferenceAgencyin theCreditNotationMismatchResolutionEnumas outlined above.boundaryIndicates the boundary of a credit agency rating i.e. minimum or maximum.

A condition exists, such that if the mismatch resolution choice is

ReferenceAgency, you must ensure that the reference agency is

specified through the CreditRatingAgencyEnum

For example:

Through CreditNotation the following data has been specified:

S&P AAA

Moodys Aaa

Fitch AAA

Then one of these needed to be specified as the dominant rating as an

example (Moodys), you would express mismatchResolution ->

CreditNotationMismatchResolutionEnum -> ReferenceAgency

referenceAgency -> CreditRatingAgencyEnum -> Moodys

Collateral Taxonomy

It is understood that data used to determine asset types used in specifying eligible collateral information can often refer to common structured standard pre-defined taxonomy sources. Although the purpose of the CDM is to encourage one standard representation of data for asset types, there are circumstances where assets are organised and labelled into categories, such as by regulators. In some circumstances, it may be a requirement to refer to these identifiable sources. In the CDM, these taxonomy sources can be referenced in a consistent representation.

The CDM allows the definition of, and reference to, certain taxonomy

sources to be used to express details for eligibility. These can be used

as an additional means of expressing asset types outside of the

descriptions tree or alongside it. Under data type CollateralCriteria there

are data attributes to reference collateral related taxonomy sources as

follows:

Data Type collateralTaxonomy will allow for specification of the

collateral taxonomy, which is composed of a taxonomy value and a

taxonomy source.

- The data attribute

taxonomySourcemust be specified and will provide the following options through the enumerations list:- CFI (The ISO 10962 Classification of Financial Instruments code)

- ISDA (The ISDA product taxonomy)

- ICAD (ISDA Collateral Asset Definition Identifier code)

- EU EMIR Eligible Collateral Asset Class (European Union Eligible Collateral Assets classification categories based on EMIR Uncleared Margin Rules)

- UK EMIR Eligible Collateral Asset Class (UK EMIR Eligible Collateral Assets classification categories based on UK EMIR Uncleared Margin Rules)

- US CFTC PR Eligible Collateral Asset Class (US Eligible Collateral Assets classification categories based on Uncleared Margin Rules published by the CFTC and the US Prudential Regulators)

The options CFI, ISDA and ICAD would be further expressed with the

flexible data 'string' representation through data type

ProductTaxonomy.

However the regulatory 'Eligible Collateral Asset Class' rules have

individual enumeration lists unique to their asset class categories

identified under each of the respective regulatory bodies. Therefore if

these are selected as taxonomy sources through TaxonomySourceEnum it is

required to specify details from the related unlimited enumeration lists

that exist under data type CollateralTaxonomyValue, these are shown

below:

eu_EMIR_EligibleCollateraluk_EMIR_EligibleCollateralus_CFTC_PR_EligibleCollateralnonEnumeratedTaxonomyValue

Please note: The regime codes are not mandatory and are based on reference to the regulatory eligible categories, but do not qualify the regulations. The CDM only provides a standard data representation so that institutions can recognise the same information.

Each enumeration has a full description of what regulatory published

rules the list of eligible collateral assets classification

codes/categories are based on. Under each enumeration list there are a

number of categorised eligible asset groups which have been identified

under each set of regulatory rules. Some limited examples of these are

shown below which are contained in the EU_EMIR_EligibleCollateralEnum

list:

EU_EMIRTypeA- Denotes Cash in the form of money credited to an account in any currency, or similar claims for the repayment of money, such as money market deposits.EU_EMIRTypeB- Denotes gold in the form of allocated pure gold bullion of recognised good delivery.EU_EMIRTypeC- Denotes debt securities issued by Member States' central governments or central banks.

The cardinality for these enumeration lists (0..*) denotes that multiple values can be provided so several categories can be applied to a line of data expressed in an eligibility profile.

The final attribute in CollateralTaxonomyValue,

nonEnumeratedTaxonomyValue, offers additional data expression outside

of the listed taxonomy values, for use when a taxonomy value is not

enumerated in the model.

There are conditions associated to the use of the data attributes within

CollateralTaxonomyValue to ensure correct use of the data. These

conditions enforce the specified regulatory enumerated list to match the

taxonomy source. Therefore as an example you can only specify a category

from the EMIR enumerations list if the taxonomy source is

EU_EMIR_EligibleCollateralAssetClass

Maturity Profiles

The expression of collateral life span periods and specific maturity

dates is a common eligibility characteristic and may be needed for

determining other key collateral treatments such as haircut percentages.

The CDM has various approaches for representing assets maturities, they

are data attributes within the data type AssetMaturity as follows:

maturityType- Allows specification of the type of maturity range and has the following enumerated values:- Remaining Maturity

- Original Maturity

- From Issuance

maturityRangeAllows filtering on the underlying asset maturity through definition of a lower and upper bound range using data typePeriodRange. UsingPeriodBoundfor both ends of the scale you would need to specify the period, for example:lowerBound1Y , representing one year using thePeriod>periodMultiplier1 and periodPeriodEnumYupper bound5Y, representing 5 years using thePeriod>periodMultiplier5 and periodPeriodEnumY- In addition

PeriodBoundhas the inclusive boolean to indicate whether the period bound is inclusive, e.g. for a lower bound, false would indicate greater than, whereas true would indicate greater than or equal to.

A combination of these data attributes combined allows specificity of the maturity profile of collateral asset types and definition of a range that would sit alongside the other asset data criteria. Multiple maturity ranges can be listed for and associated to one asset type, varied collateral treatment haircuts can then be added to each of the ranges, this would be a common feature of a collateral eligibility schedule especially if there is an uncleared margin rules regulatory requirement.

Asset Identifier

The CDM model as described throughout this guide will allow the user to

define collateral assets through the granular structure of the

CollateralCriteria, but we must understand that expression of asset details

for eligibility purposes can take other forms across the universe of

collateral, for some processes there is a requirement to use specific identifiers

for particular financial products. The data type SpecificAsset can be used to

express specific instrument identifiers such as ISINs, CUSIPs etc. There

is a section within the CDM documentation that covers this area of the

model, this can be found in the following link

products-with-identifiers-section.

Listing

Additional details may be required to describe asset characteristics

related to a security's financial listing, exchange, or sector. If relevant, these are used to express eligibility details in

documentation and collateral profiles. The following attributes on

CollateralCriteria can be used to

specify such listing criteria.

ListingExchangeRepresents a filter based on the primary stock exchange facilitating the listing of companies, exchange of Stocks, Exchange traded Derivatives, Bonds, and other Securities.ListingSectorRepresents a filter based on an industry sector defined under a system for classifying industry types such as 'Global Industry Classification Standard (GICS)' and 'North American Industry Classification System (NAICS) or other related industry sector reference data.

Combining Data in Eligible Collateral

Combining Criteria & Treatments

This user guide provides an overview of the data available to represent details for expressing eligibility inclusive of the collateral criteria and the collateral treatment inclusion rules, valuation percentages and concentration limits. However, a combination of how the data is represented and structured will determine specific outcomes.

The data can be specified and organised as a list of attributes, such as descriptive details of the asset and the issuer, to identify the makeup of collateral.

Each list combination identified in this way can then have specific treatment rules applied to it.

For example, a simple list can be constructed as follows:

CollateralCriteria

- AssetType -> assetType: CASH

- denominatedCurrency: USD

And then the following treatment applied to the list

Treatment

- isIncluded: TRUE

- haircutPercentage**: 0.005**

The outcome is- USD CASH IS ELIGIBLE AT 99.5% VALUE/ or WITH 0.5% HAIRCUT

Automating Construction

In typical industry practice, eligible collateral schedules are quite complex with a number of interacting terms.

To digitize them in the CDM, they will need to be converted into an EligibleCollateralSpecification

with many EligibleCollateralCriteria with potentially recursive instances of CollateralCriteria.

The construction of these terms can be quite laborious, so functions have been created in the CDM to provide

a level of automation.

CloneEligibleCollateralWithChangedTreatment

This function creates a new Eligible Collateral Specification based on an input specification, but with one changed criteria and with one changed treatment.

The inputs are populated as follows:

inputSpecification: anEligibleCollateralSpecificationcontaining the fully-formed data to be cloned.changedCriteria: a singleCollateralCriteriaattribute containing the specific attribute and value to be changed.changedTreatment: a singleCollateralTreatmentattribute containing the specific treatment and value to be changed.

Example

A collateral eligibility schedule agreed between two parties specifies the acceptable collateral as being a list of certain types of fixed income bonds, from certain types of issuer, in certain countries, and denominated in a list of acceptable currencies. Across all these bonds, different haircut treatments must be applied, depending on the maturity of the bond.

If the user provides a collateral schedule containing US Government bonds with a haircut of 5% applied, they can use the CloneEligibleCollateralWithChangedTreatment to produce a collateral schedule of HM Treasury gilts with a haircut of 10%.

The EligibleCollateralSpecification required to model this case needs to be constructed using potentially many EligibleCollateralCriteria, which are themselves constructed from CollateralTreatment and CollateralCriteria to correctly represent the conditions regarding the bond types, issuer types, and currencies. For each of the maturity bands, this EligibleCollateralCriteria must have a specific Treatment specifying the terms of the haircut.

To use the CloneEligibleCollateralWithChangedTreatment function to automate this, one starts by first creating the EligibleCollateralCriteria for US Government bonds, with all the required constituent parts, and a haircut Treatment of 5%.

The function is then invoked, using this EligibleCollateralCriteria as the inputSpecification, along with the criteria and treatment changes using the changedCriteria and changedTreatment inputs. This means changing the AssetCountryOfOrigin to the UK, and changing the haircut valuationTreatment to 10%.

The function will provide a fully formed output consisting of an EligibleCollateralSpecification containing all the required EligibleCollateralCriteria with their updated changes and treatments.

MergeEligibleCollateralCriteria

This is the function in the CDM that actually does the work of the construction. However, unlike most functions in CDM, the implementation is in bespoke Java code, albeit still within the CDM Distribution.

Validating Eligible Collateral

A CDM function has been developed to run eligibility validation checks which can be applied to several use cases. The function requires two sets of information to be present as CDM data:

- a set of eligible collateral criteria, including asset and issuer details, maturity profiles, haircuts and

any other required characteristics, all modelled in an

EligibleCollateralSpecification. - a defined list of characteristics of the collateral that is to be tested against the eligibility details, defined

in an

EligibilityQuery.

Overview

The function uses the CDM collateral representation already built to test collateral eligibility against multiple minimum

collateral requirements and specific eligible collateral schedules. Essentially it is testing different criteria sets built

from the EligibleCollateralSpecification root type against each other as an example:

-

The margin rules set by a specific regulation state that market participants must post collateral using, at a minimum, bonds with a maturity of 5 years or more from a specific set of countries. The CDM can represent this information using the

EligibleCollateralSpecificationas a list ofEligibleCollateralCriterias. -

The

EligibilityQueryis used to check whether assets that a participant has available are allowed to be posted as collateral. This could be a set of simple questions presented as CDM data:- Is an EU bond with 4 years remaining maturity eligible? If so, what are applicable haircuts?

- Are JGBs with a 3 year remaining maturity eligible? If so, what are applicable haircuts?

- Is GBP (cash) eligible? If so, what are applicable haircuts?

The function CheckEligibilityByDetails, when presented with the 2 sets sets of input information, will check to determine

which collateral meets the eligibility and can be used/posted for delivery, and will return the breakdown

CheckEligibilityResult as output including information such as haircuts.

EligibilityQuery

The data type EligibilityQuery is used to form the input data to the Eligibility Collateral Validation function.

type EligibilityQuery:

maturity number (1..1)

collateralAssetType AssetType (1..1)

assetCountryOfOrigin ISOCountryCodeEnum (1..1)

denominatedCurrency CurrencyCodeEnum (1..1)

agencyRating AgencyRatingCriteria (1..1)

issuerType CollateralIssuerType (1..1)

issuerName LegalEntity (1..1)

The data type should be populated with data to describe the collateral that is being validated, as follows:

maturity: the number of remaining years until maturity, as a numbercollateralAssetType: the type of collateral using theAssetTypedata type and related enumeratorsassetCountryOfOrigin: specified using the ISO Country CodedenominatedCurrency: specified using the Currency Code enumeratoragencyRating: the rating assigned to the asset by an agency, using theAgencyRatingCriteriadata typeissuerType: the type of entity that issued the asset, using theCollateralIssuerTypedata typeissuerName: the name or identifier of the issuer of the asset, using theLegalEntitydata type.

All attributes in the query must be populated and all are of single cardinality.

CheckEligibilityByDetails

The function CheckEligibilityByDetails performs the actual validation based on the description of the available

collateral (specified in the aforementioned EligibilityQuery) and an eligibility collateral schedule (defined as

an EligbilityCollateralSpecification).

The required inputs are one single EligbilityCollateralSpecification and one single EligibilityQuery.

The output is a single eligibility result, using the CheckEligibilityResult data type, described next.

In practical terms, the function can be integrated into systems and applications using the CDM code generators to create executable software in one of many software languages, typically Java. For testing and demononstration purposes, the input data can be built manually using the FINOS CDM Object Builder and loaded and run using the Function evaluation feature in the Rosetta Engine product.

CheckEligibilityResult

The output of the function is delivered using the CheckEligibilityResult data type which has four attributes:

type CheckEligibilityResult:

isEligible boolean (1..1)

matchingEligibleCriteria EligibleCollateralCriteria (0..*)

eligibilityQuery EligibilityQuery (1..1)

specification EligibleCollateralSpecification (1..1)

isEligible: a simple boolean which is set to true if the asset described in theEligibilityQueryinput is eligible.matchingEligibleCriteria: if there was a match, this will be the one or more criteria that were supplied in theEligbilityCollateralSpecificationwhich matched with the query input.eligibilityQuery: a copy of the input query that was checked against the eligible collateral specification.specification: a copy of the inputEligbilityCollateralSpecificationthat was checked against the query.

Example Eligibility Check

Let's take an example eligible collateral schedule that accepts government bonds with outstanding

maturity of more than one year. This can be coded into an EligibilityCollateralSpecification, as the

first parameter of the validation function; here illustrated as JSON:

EligibilityCollateralSpecification

{ "criteria": [ {

"asset": [ {

"collateralAssetType": [ {

"assetType": "SECURITY"

"securityType": "DEBT"

} ],

"maturityRange": {

"lowerBound": {

"period": {

"period": "Y",

"periodMultiplier": 1

} } } } ],

"issuer": [ {

"issuerType": [ {

"issuerType": "SOVEREIGN_CENTRAL_BANK"

} ] } ] } ] }

We can then run eligibility tests against this, for example:

- Is US dollar cash accepted as collateral for this schedule?

- Are JGBs with a 3-year remaining maturity eligible? If so, what are applicable haircuts?

Showing this as JSON code, the first EligibilityQuery would be:

{ "query": {

"collateralAssetType": [ {

"assetType": "Cash"

} ] ,

"assetCountryOfOrigin": "US" ,

"demoninatedCurrency": "USD"

} }

Running this code through the EligibilityQuery function will generate a result of False

in the isEligible attribute.

For the second example, the query can be constructed as follows:

{ "query": {

"maturity": 3,

"collateralAssetType": [ {

"assetType": "Security",

"securityType": "Debt"

} ] ,

"assetCountryOfOrigin": "JP" ,

"demoninatedCurrency": "JPY",

"agencyRating": {

"qualifier" : "All",

"creditNotation" : [ {

"agency": "StandardAndPoors",

"notation": "AA"

} ]

} ,

"issuerType": "SOVEREIGN_CENTRAL_BANK" ,

"issuerName": "Government of Japan"

} }

The above will generate a result of True in the isEligible attribute. To determine the

applicable haircut, interogate the returned CheckEligibilityResult data type, and specifically

matchingEligibleCriteria -> treatment -> valuationTreatment -> haircutPercentage.

CheckEligibilityForProduct

The Function CheckEligibilityForProduct, which takes a specific Product as the input and validates

its eligibility, has been defined conceptually but not fully implemented.