Product Model

Financial Product

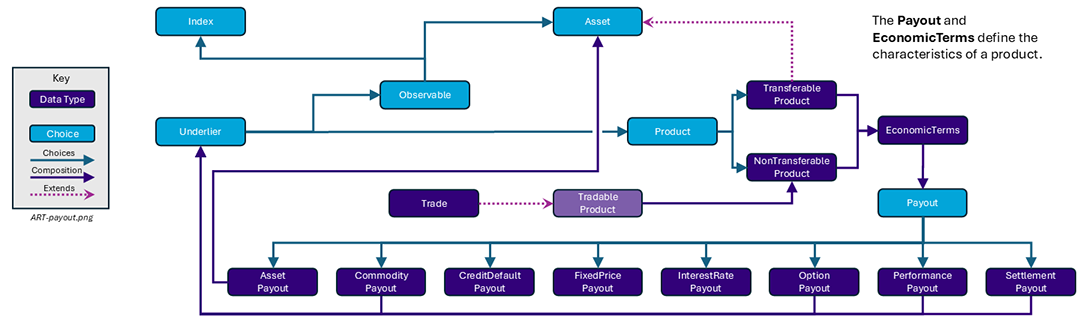

In the CDM, a financial product describes a thing that is used to transfer financial risk between two parties.

The model is based on several building blocks to define the characteristics of that risk transfer.

The most fundamental of these building blocks is an Asset, which represents

a basic, transferable financial product such as cash, a commodity or security.

From those basic transferable assets, any other financial product can be built using

other composable building blocks called Payout that are assembled to represent the

complete EconomicTerms of that product.

A Payout is a parametric description of the commitment between two parties to the transfer

of one or more assets in the future - for instance, but not exclusively, future cashflows

when that asset is cash. These future transfers may be contingent on the future value

or performance of that asset or other, as in the case of options.

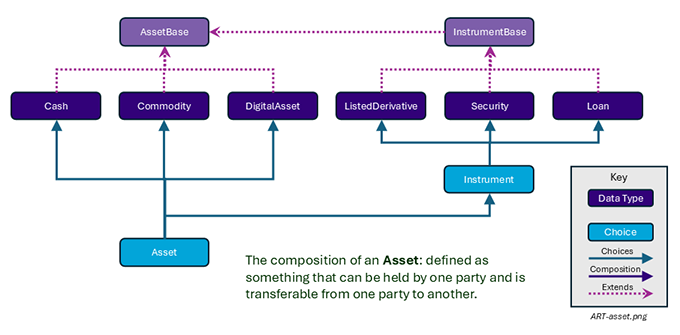

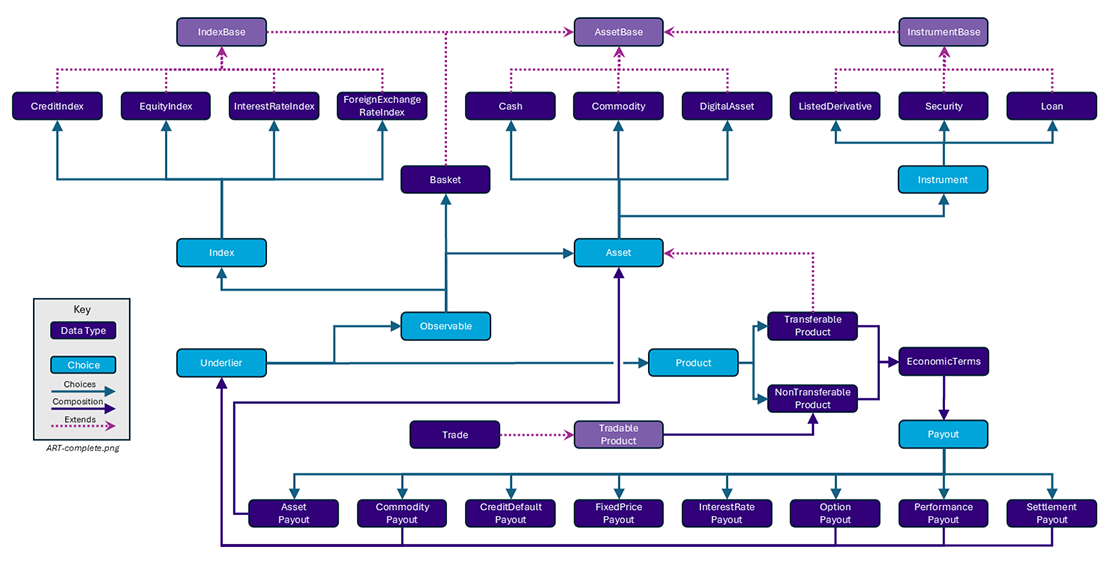

Asset

An Asset is defined as something that can be held by one party and is transferable from one party to another: for example, cash, a commodity, a loan or a security.

The Asset data type is represented as a choice of several underlying data types, which means one and only one of those data types must be used.

choice Asset:

Cash

Commodity

DigitalAsset

Instrument

Each of the choice values are defined as data types within the model and each also extends a common base type

AssetBase:

type AssetBase:

identifier AssetIdentifier (1..*)

taxonomy Taxonomy (0..*)

isExchangeListed boolean (0..1)

exchange LegalEntity (0..1)

relatedExchange LegalEntity (0..*)

The data types are designed to carry the minimal amount of information that is needed to uniquely identify the asset in question.

The base type ensures that every instance of all types of an Asset has a defined AssetIdentifier which is

itself composed of an identifier and an identifierType enumerator that defines the symbology source of the identifier,

for example a CUSIP or ISIN.

The base type also includes an optional taxonomy which aligns the asset to one of the asset classification

sources defined by industry organisations, such as ISDA, or regulators, such as CFTC or ESMA. It is also possible

to define the exchange listing characteristics of the asset.

Conditions are applied on each of the asset types to enforce certain rules; for example, a Cash asset

can not have an exchange.

The Asset definitions are as follows:

- Cash: An asset that consists solely of a monetary holding in a currency. The only attribute on this

data type is the

Identifier, populated with the currency code (using theCurrencyCodeEnumlist) for the currency of the cash. - Commodity: An Asset comprised of raw or refined materials or agricultural products, eg gold, oil or wheat.

The applicable identifiers are the ISDA definitions for reference benchmarks. If no such benchmark exists, the

characteristics of a commodity asset can be more fully identified using a

CommodityProductDefinition. - DigitalAsset: An Asset that exists only in digital form, eg Bitcoin or Ethereum; excludes the digital representation of other Assets.

- Instrument: An asset that is issued by one party to one or more others; Instrument is also a choice data type.

Instrument

The Instrument data type is further broken down using the choice construct:

choice Instrument:

ListedDerivative

Loan

Security

with these attributes:

- ListedDerivative: A securitized derivative on another asset that is created by an exchange. If the particular

contract cannot be fully identified using the

identifier, the optionaldeliveryTerm,optionTypeandstrikeattributes can be populated. - Loan: An Asset that represents a loan or borrow obligation. As loans rarely have standard industry identifiers,

the data type includes optional attributes to help uniquely identify the loan, including

borrower,lien,facilityType,creditAgreementDateandtranche. - Security: An Asset that is issued by a party to be held by or transferred to others. As "security" covers a

broad range of assets, the

securityTypeattribute (which is a list of enumerators includingDebtandEquity) must always be specified. Further categorisation, bydebtType,equityTypeandFundType, can also be used and are governed by conditions on the data type definition.

All the Instrument data types extend InstrumentBase, which itself extends AssetBase.

Each type of instrument also has its own definitions with additional attributes which are required to uniquely

identify the asset.

The additional attributes on Loan can be used when needed to uniquely identify the specific loan:

type Loan extends InstrumentBase:

borrower LegalEntity (0..*)

lien string (0..1)

[metadata scheme]

facilityType string (0..1)

[metadata scheme]

creditAgreementDate date (0..1)

tranche string (0..1)

[metadata scheme]

Likewise, additional ListedDerivative attributes are used to uniquely identify the contract:

type ListedDerivative extends InstrumentBase:

deliveryTerm string (0..1)

optionType PutCallEnum (0..1)

strike number (0..1)

condition Options:

if optionType exists then strike exists else strike is absent

Note: The conditions for this data type are excluded from the snippet above for purposes of brevity.

Security has a set of additional attributes, as shown below:

type Security extends InstrumentBase:

securityType SecurityTypeEnum (1..1)

debtType DebtType (0..1)

equityType EquityType (0..1)

fundType FundProductTypeEnum (0..1)

condition DebtSubType:

if securityType <> Debt

then debtType is absent

condition EquitySubType:

if securityType <> Equity

then equityType is absent

condition FundSubType:

if securityType <> Fund

then fundType is absent

condition AssetType:

assetType = Security

The asset identifier will uniquely identify the security. The

securityType is required for specific purposes in the model, for

example for validation as a valid reference obligation for a Credit

Default Swap. The additional security details are optional as these

could be determined from a reference database using the asset

identifier as a key.

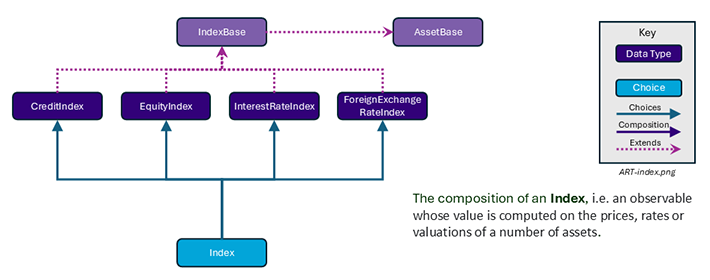

Index

An Index is data type to record information about prices, rates or

valuations of a number of assets that are tracked in a standardized way.

Examples include equity market indices as well as indices on interest rates,

foreign exchange rates, inflation and credit instruments.

The index data types extend the IndexBase data type which in turn

extends the AssetBase type. Within IndexBase, an index name can

be assigned, the index provider can be identified, and the asset

class specified.

Observable

In addition to assets, there are variables which can be observed in the markets and which can directly influence the outcomes of financial products. In the CDM, the observed value represents the price of an "observable".

The Observable data type specifies the reference object whose price is to be observed.

It could be an underlying asset, if it can be held or transferred,

or something which can be observed but not transferred, such as an index.

In addition to Asset, the Observable is a choice betwen the following data types:

choice Observable:

Asset

Basket

Index

- Asset: The inclusion of Asset in Observable enables the price of an asset to be included within the definition of another financial product.

- Basket: The object to be observed is a Basket, ie a collection of Observables with an identifier and optional weightings.

- Index: The object to be observed is an Index, ie an observable whose value is computed on the prices, rates or valuations of a number of assets.

Like Asset, both the Basket and Index types also extend AssetBase. This ensures that all types of Observable share

a common set of attributes, in particular an identifier.

The CDM allows both assets and observables to be used as underlying building blocks to construct complex products (see the Underlier section).

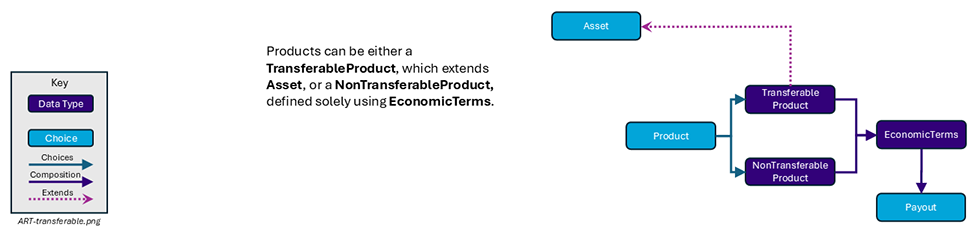

Product

The model defines a product using three attributes:

- identifier: a product must have a unique identifier composed of an

identifierstring and anidentifierTypeenumerator that defines the symbology source of the identifier. - taxonomy: a product can be classified according to one or more classification sources. Compared to assets, the taxonomy value can be inferred from the product's economic terms rather than explicitly naming the product type.

- economicTerms: a parametric representation of the future financial obligations (e.g. cashflows) generated by the product, built by composing payouts.

The first two attributes are common with the definition of an asset. Therefore, the defining feature of a product compared with an asset is that it includes economic terms.

There are two types of products:

- A transferable product associates an asset, itself transferable, with the economic terms describing that asset.

- A non-transferable product describes a commitment between two parties to one or more transfers of assets in the future.

choice Product:

TransferableProduct

NonTransferableProduct

TransferableProduct

Because an asset is a basic type of financial product, the Asset data type only needs to provide limited information

about that product: essentially it allows to identify the product using publicly available identifiers.

Sometimes, there is a need to specify the full economic terms of that product, when that product in turn

generates some future asset transfers - e.g. cashflows in the case of a loan, bond or equity (dividends).

This is supported by the TransferableProduct data type.

A TransferableProduct is a type of Product which allows to specify the EconomicTerms of an Asset. It can be used as the underlier of a basic Payout that describes the buying and selling of that Asset.

type TransferableProduct extends Asset:

economicTerms EconomicTerms (1..1)

Because TransferableProduct extends Asset, it inherits its identifier and taxonomy attributes from it.

In that case, those attributes are of type, respectively, AssetIdentifier and Taxonomy.

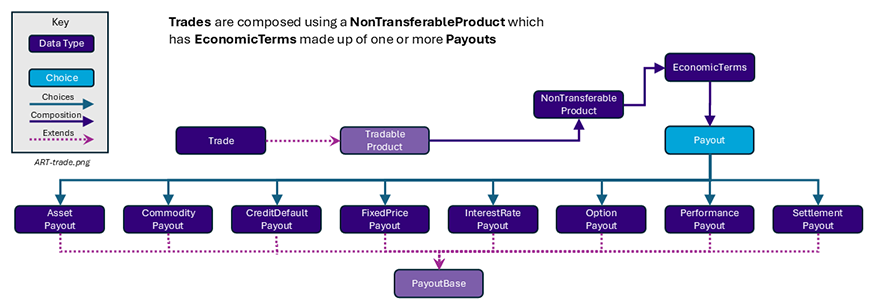

NonTransferableProduct

By contrast with a transferable product, which can be held by a single party who can in turn transfer it to another, some financial products consist of bilateral agreements between two parties. As such, they cannot be freely transferred by one of the parties to a third party (at least not without the consent of the other party). Such product is usually materialised by a financial contract between those parties and can also be referred to as a "contractual" product.

In the CDM, those products are represented by the NonTransferableProduct type:

A non-transferable product represents a financial product that is agreed bilaterally between two parties. The data type specifies the financial product's economic terms alongside its identifier and taxonomy. A non-transferable product is instantiated by a trade between the two parties that defines the tradable product, and evolves through the CDM's lifecycle event model.

type NonTransferableProduct:

[metadata key]

identifier ProductIdentifier (0..*)

taxonomy ProductTaxonomy (0..*)

economicTerms EconomicTerms (1..1)

While a NonTransferableProduct shares the identifier and taxonomy attributes with its TransferableProduct counterpart,

those attributes use different types, respectively:

ProductIdentifieruses a more restrictive enumerator to specify theidentifierTypecompared toAssetIdentifier.ProductTaxonomyenriches the simplerTaxonomydata type with the product's primary and secondary asset classes using theAssetClassEnum, which leverages the FpML classification.

Compared with Asset and Observable, which are minimally defined, the modelling of a contractual product requires a larger data structure to support the representation of economic terms.

The terms of the contract are specified at trade inception and apply throughout the life of the contract (which can last for decades for certain long-dated products) unless amended by mutual agreement. Contractual products may be fungible (replaceable by other identical or similar contracts) only under specific terms: e.g. the existence of a close-out netting agreement between the parties.

Given that each contractual product transaction is unique, all of the contract terms must be specified and stored in an easily accessible transaction lifecycle model so that each party can evaluate their financial risks during the life of the agreement.

Product Scope

The scope of (non-transferable) products in the model is summarized below:

- Interest rate derivatives:

- Interest Rate Swaps (incl. cross-currency swaps, non-deliverable swaps, basis swaps, swaps with non-regular periods, ...)

- Swaptions

- Caps/floors

- FRAs

- OTC Options on Bonds

- Credit derivatives:

- Credit Default Swaps (incl. baskets, tranche, swaps with mortgage and loan underliers, ...)

- Options on Credit Default Swaps

- Equity derivatives:

- Equity Swaps (single name)

- Options:

- Any other OTC Options (incl. FX Options)

- Securities Lending:

- Single underlyer, cash collateralised, open/term security loan

- Repurchase Agreements:

- Open Term, Fixed Term, Fixed Rate, Floating Rate

Economic Terms

Represents the full set of features associated with a product: the payout component; the notional/quantity; the effective date, termination date and the date adjustment provisions which apply to all payouts. This data type also includes the legal provisions which have valuation implications: cancelable provision; extendible provision; early termination provision; and extraordinary events specification. It defines all the commitments between the parties to pay or transfer during the life of the trade.

The CDM specifies the various sets of possible remaining economic terms

using the EconomicTerms type. This type includes contractual

provisions that are not specific to the type of payout, but do impact

the value of the contract, such as effective date, termination date,

date adjustments, and early termination provisions. A valid population

of this type is constrained by a set of conditions which are not shown

here in the interests of brevity.

type EconomicTerms:

effectiveDate AdjustableOrRelativeDate (0..1)

terminationDate AdjustableOrRelativeDate (0..1)

dateAdjustments BusinessDayAdjustments (0..1)

payout Payout (1..*)

terminationProvision TerminationProvision (0..1)

calculationAgent CalculationAgent (0..1)

nonStandardisedTerms boolean (0..1)

collateral Collateral (0..1)

Payout

The Payout type defines the composable payout types, each of which

describes a set of terms and conditions for the financial

obligation between the contractual parties. Payout types can be

combined to compose a product.

Represents the set of future cashflow methodologies in the form of

specific payout data type(s) which combine to form the financial product.

Examples: a "cash" trade (buying and selling an asset) will use a settlement payout;

for derivatives, two interest rate payouts can be combined to specify

an interest rate swap; one interest rate payout can be combined with

a credit default payout to specify a credit default swap; an equity swap

combines an interest rate payout and a performance payout; etc.

choice Payout:

[metadata key]

AssetPayout

CommodityPayout

CreditDefaultPayout

FixedPricePayout

InterestRatePayout

OptionPayout

PerformancePayout

SettlementPayout

All payout types extend a common data type called PayoutBase.

This data type provides a common structure for attributes such as

quantity, price, settlement terms and the payer/receiver direction which

are expected to be common across many payouts.

type PayoutBase:

payerReceiver PayerReceiver (1..1)

priceQuantity ResolvablePriceQuantity (0..1)

principalPayment PrincipalPayments (0..1)

settlementTerms SettlementTerms (0..1)

For example:

type InterestRatePayout extends PayoutBase:

rateSpecification RateSpecification (0..1)

dayCountFraction DayCountFractionEnum (0..1)

[metadata scheme]

calculationPeriodDates CalculationPeriodDates (0..1)

paymentDates PaymentDates (0..1)

paymentDate AdjustableDate (0..1)

paymentDelay boolean (0..1)

resetDates ResetDates (0..1)

discountingMethod DiscountingMethod (0..1)

compoundingMethod CompoundingMethodEnum (0..1)

cashflowRepresentation CashflowRepresentation (0..1)

stubPeriod StubPeriod (0..1)

bondReference BondReference (0..1)

fixedAmount calculation (0..1)

floatingAmount calculation (0..1)

Note: The code snippets above excludes the conditions in this data type for purposes of brevity.

There are a number of components that are reusable across several payout

types. For example, the CalculationPeriodDates class describes the

inputs for the underlying schedule of a stream of payments.

type CalculationPeriodDates:

[metadata key]

effectiveDate AdjustableOrRelativeDate (0..1)

terminationDate AdjustableOrRelativeDate (0..1)

calculationPeriodDatesAdjustments BusinessDayAdjustments (0..1)

firstPeriodStartDate AdjustableOrRelativeDate (0..1)

firstRegularPeriodStartDate date (0..1)

firstCompoundingPeriodEndDate date (0..1)

lastRegularPeriodEndDate date (0..1)

stubPeriodType StubPeriodTypeEnum (0..2)

calculationPeriodFrequency CalculationPeriodFrequency (0..1)

The price and quantity attributes in the PayoutBase

structure are positioned in the ResolvablePriceQuantity

data type. This data type mirrors the PriceQuantity data

type and contains both the price and quantity schedules.

That data type supports the definition of additional information such as a quantity reference, a quantity multiplier or the indication that the quantity is resettable. Those are used to describe the quantity of a payout leg that may need to be calculated based on other inputs: e.g. an exchange rate for the foreign leg in a Cross-Currency Swap or a share price for the funding leg of an Equity Swap.

type ResolvablePriceQuantity:

[metadata key]

resolvedQuantity Quantity (0..1)

quantitySchedule NonNegativeQuantitySchedule (0..1)

[metadata address "pointsTo"=PriceQuantity->quantity]

quantityReference ResolvablePriceQuantity (0..1)

[metadata reference]

quantityMultiplier QuantityMultiplier (0..1)

reset boolean (0..1)

futureValueNotional FutureValueAmount (0..1)

priceSchedule PriceSchedule (0..*)

[metadata address "pointsTo"=PriceQuantity->price]

By design, the CDM requires that each payout leg can only be associated

with a single quantity schedule that defines this leg's contractual

behaviour (e.g. for the payment of cashflows). In the PriceQuantity

object, where that attribute is of multiple cardinality, other

quantities may be provided "for information only" which can be

inferred from the main quantity used in the payout leg: e.g. when a

commodity quantity is associated to a frequency and needs to be

multiplied by the period to get the total quantity.

Both the quantitySchedule and priceSchedule attributes have a

metadata address that point respectively to the quantity and price

attributes in the PriceQuantity data type. This special

cross-referencing annotation in the Rune DSL allows to parameterise

an attribute whose value may be variable by associating it to an

address. The attribute value does not need to be populated in the

persisted object and can be provided by another object, using the

address as a reference.

Other model structures use the [metadata address] to point to

PriceQuantity->price. An example include the price attribute in the

RateSchedule data type, which is illustrated below:

type RateSchedule:

price PriceSchedule (1..1)

[metadata address "pointsTo"=PriceQuantity->price]

Underlier

The concept of an underlier allows for financial products to be used within the definition of another product to drive its outcomes, for example a forward or option (contingent on an underlying asset), an equity swap (contingent on an underlying stock price or index), or an option to enter into another financial contract (as in an interest rate or credit default swaption).

The fact that a product can be nested as an underlier in the definition of another product makes the product model composable.

The underlying financial product can be of any type: e.g. an asset such as cash or a security, an index, or a product, and may be physically or cash settled as specified in the payout definition. Conditions are usually applied when used in a payout to ensure that the type of underlier aligns with the payout's use case.

choice Underlier:

Observable

[metadata address "pointsTo"=PriceQuantity->observable]

Product

In the simplest case, the underlier in an AssetPayout can not be

cash, so the definition within this data type is constrained as such.

In a CommodityPayout or a PerformancePayout, the purpose of the underlier

is to influence the values of the future returns, so its type is restricted

to be an observable.

Option products do provide for the greatest range of outcomes and even allow the underlier

to be a NonTransferableProduct, as in the swaption case.

Use of underliers in payouts

The following table summarises the use of underliers for each of the main payout data types.

| Payout | Underlier Definition | Rationale |

|---|---|---|

AssetPayout | underlier Asset (1..1) | Specifies the Asset subject to the financing agreement, usually a Security |

CommodityPayout | underlier Underlier (1..1) | Identifies the underlying product that is referenced for pricing of the applicable leg in a swap. |

OptionPayout | underlier Underlier (1..1) | The underlier defines the exercise, which can be cash or physical, therefore it can be any of an Asset, Basket, Index or NonTransferableProduct |

PerformancePayout | underlier Underlier (0..1) | The underlier is a pricing mechanism, ie an Observable |

SettlementPayout | underlier Underlier (1..1) | The underlier that is settled and can be an Asset, Index or TransferableProduct |

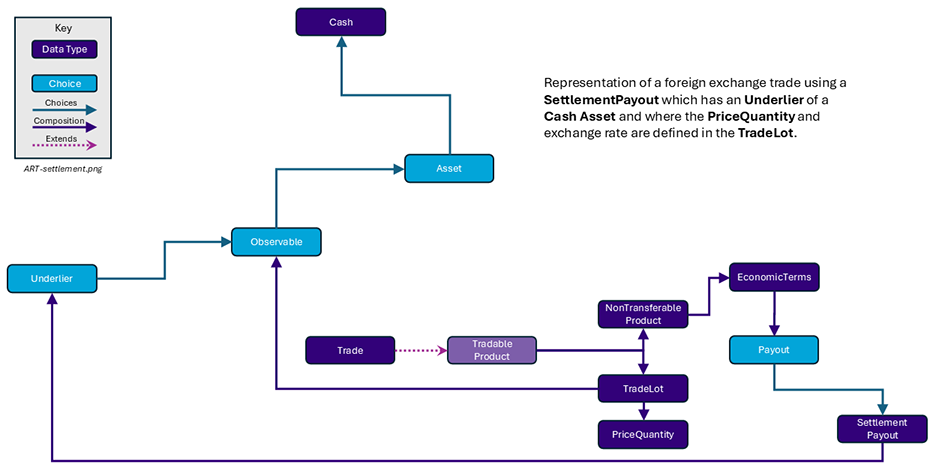

SettlementPayout

A SettlementPayout is a specialised choice of payout introduced to represent the

buying or selling of an underlying asset or product, which then needs to be settled.

A settlement payout can represent a spot or forward settling payout. The underlier

attribute captures the underlying product or asset, which is settled according to the

settlementTerms attribute (part of PayoutBase).

Conditions on the definition of SettlementPayout ensure the following are true

for the underlier:

- If it is a

Product, it must not be aNonTransferableProduct- since by definition such product cannot be settled. - If it is a

Basket, then all of the constituents of the basket must be assets. - If it is an

Index, then it must be cash settled.

SettlementPayout is used for foreign exchange trades, either spot- (cash) or

forward-dated. In this case, the underlier specifying the asset to be settled must

be of Cash type, and the price represents the exchange rate in the purchase currency.

Non-deliverable forwards can be represented using the cash-settlement option.

Tradable Product

A tradable product represents a financial product that is ready to be

traded, meaning that there is an agreed financial product, price,

quantity, and other details necessary to complete the execution of a

negotiated contract between two counterparties. Tradable products

are represented by the TradableProduct data type.

Definition of a financial product as ready to be traded, i.e. included in an execution or contract, by associating a specific price and quantity to the product definition, plus optional conditions for any potential future quantity adjustment. A tradable product does not define the trade date, execution details or other information specific to the execution event but allows for multiple trade lots, quantities and prices, between the same two counterparties.

type TradableProduct:

product NonTransferableProduct (1..1)

tradeLot TradeLot (1..*)

counterparty Counterparty (2..2)

ancillaryParty AncillaryParty (0..*)

adjustment NotionalAdjustmentEnum (0..1)

Note: The conditions for this data type are excluded from the snippet above for purposes of brevity.

The primary set of attributes represented in the TradableProduct data

type are ones that are shared by all trades. Every trade is based on a

financial product and has a price, a quantity (treated jointly as a

trade lot), and a pair of counterparties. In some cases, there are ancillary

parties, or an allowable adjustment to the notional quantity. All of the

other attributes required to describe the trade's economic terms are defined

in the NonTransferableProduct data type.

There are cases when the object of a trade is a transferable product

whose economic terms are already set: for instance when buying or selling

a fungible instrument like a security or a loan. In those cases, the terms

of that trade still need to be contractually agreed betwwen the parties.

This contract's terms would be defined in a Payout and embedded in a

NonTransferableProduct which is not transferable, even though

the underlying product may be.

In its simplest form, that trade's terms will specify the settlement date

in addition to the price and quantity and can be represented using the

SettlementPayout.

A TradableProduct also provides a mechanism to trade indices that

otherwise cannot be directly transfered. The Payout would define how

the index is meant to be observed and the resulting cashflows between

the parties based on that observed value.

This example shows the structure for a foreign exchange trade which is composed of:

- a

Tradeand aTradableProduct - a

NonTransferableProductcomposed using a singleSettlementPayout. This in turn has aCashunderlier which specifies the currency of the payout. - a

TradeLotcontaining aPriceQuantity, which defines the price of the underlier, expressed as a quantity in the second currency, and an exchange rate.

Counterparty

The counterparty attribute of a TradableProduct is constrained to be

exactly of cardinality 2. The CDM enforces that a transaction can only

occur between a pair of counterparties, with any other party involved in

the transaction represented by the ancillaryParty attribute.

The counterparty attribute uses the Counterparty data type, which

links a specific Party object identifying that party to its role in

the transaction. The counterparty roles in the CDM are normalised to be

either Party1 or Party2 and captured as a pair of enumerated values.

This design allows to use anonymised Party1 and Party2 values to

specify the direction of flows in the definition of a tradable product

without having to reference specific parties. This means that the same

product can now be defined in a party-agnostic way and used to represent

transactions between potentially many different parties.

type Counterparty:

role CounterpartyRoleEnum (1..1)

partyReference Party (1..1)

[metadata reference]

enum CounterpartyRoleEnum:

Party1

Party2

type Party:

[metadata key]

partyId PartyIdentifier (1..*)

name string (0..1)

[metadata scheme]

businessUnit BusinessUnit (0..*)

person NaturalPerson (0..*)

personRole NaturalPersonRole (0..*)

account Account (0..1)

contactInformation ContactInformation (0..1)

Note:

The partyReference attribute in Counterparty is annotated with a

[metadata reference], which means that a reference to the party object

can be passed in instead of a copy. In that case, the attribute's type

must itself be annotated with a [metadata key], so that it is

referenceable via a key. The use of the key / reference mechanism is

further detailed in the Rune DSL documentation.

TradeLot

A trade lot represents the quantity and price at which a product is being traded.

In certain markets, trading the same product with the same economics

(except for price and quantity) and the same counterparty may be treated

as a separate trade. Each trade is represented by a tradable product

containing only 1 trade lot. In other markets, trading the same product

with the same characteristics (except for price and quantity) is

represented as part of the same trade. In this case, a single tradable

product contains mulle trade lots represented as an array of the

TradeLot data type.

When a trade can have mulle trade lots, increases (or upsize) and

decreases (or unwind) are treated differently. An increase adds a new

TradeLot instance to the tradadable product, whereas a decrease

reduces the quantity of one or more of the existing trade lots.

Specifies the prices and quantities of one or more trades, where the same product could be traded multiple times with the same counterparty but in different lots (at a different date, in a different quantity and at a different price). One trade lot combined with a product definition specifies the entire economics of a trade. The lifecycle mechanics of each such trade lot (e.g. cashflow payments) is independent of the other lots. In a trade decrease, the existing trade lot(s) are decreased of the corresponding quantity (and an unwind fee may have to be settled).

Note: The term lot is borrowed from the Equity terminology that refers to each trade lot as a tax lot, where the capital gains tax that may arise upon unwind is calculated based on the price at which the lot was entered.

For each trade lot, the quantity and price are represented by an

attribute called priceQuantity.

type TradeLot:

lotIdentifier Identifier (0..*)

priceQuantity PriceQuantity (1..*)

The pricequantity attribute is represented as an array of the

PriceQuantity data type. For composite financial products that are

made of different legs, each leg may require its own price and quantity

attributes, and each instance of a PriceQuantity data type identifies

the relevant information for the leg of a trade. For example, for an

Interest Rate Swap, a trade lot would have one instance of the

PriceQuantity data type for each interest leg, and potentially a third

one for an upfront fee. By comparison, the purchase or sale of a

security or listed derivative would typically have a single

PriceQuantity instance in the trade lot.

PriceQuantity

The price and quantity attributes of a trade, or of a leg of a trade in

the case of composite products, are part of a data type called

PriceQuantity. This data type also contains (optionally):

- an observable, which describes the asset or reference index to which the price and quantity are related

- settlement terms and the buyer/seller direction, in case that price and quantity are meant to be settled

- a date, which indicates when these price and quantity become effective

type PriceQuantity:

[metadata key]

price PriceSchedule (0..*)

[metadata location]

quantity NonNegativeQuantitySchedule (0..*)

[metadata location]

observable Observable (0..1)

[metadata location]

effectiveDate AdjustableOrRelativeDate (0..1)

Note: The conditions for this data type are excluded from the snippet above for purposes of brevity.

The price, quantity and observable attributes are joined together in a

single PriceQuantity data type because in some cases, those 3

attributes need to be considered together. For example, the return leg

of an Equity Swap will have:

- the identifier for the shares as

observable - the number of shares as

quantity - the initial share price as

price

However, those attributes are optional because in other cases, only some

of them will be specified. In the fixed leg of an Interest Rate Swap,

there is no observable as the rate is already fixed. An option trade

will contain an instance of a PriceQuantity containing only the

premium as price attribute, but no quantity or observable (the quantity

and/or observable for the option underlyer will be specified in a

different PriceQuantity instance).

Both the price and quantity can be specified as arrays in a single

PriceQuantity. All elements in the array express the same values but

according to different conventions. For example, the return leg of an

Equity Swap may specify both the number of shares and the notional (a

currency amount equal to: number of shares x price per share) as

quantities. In a Forward FX trade, the spot rate, forward points and

forward rate (equal to spot rate + forward points) may all be specified

as prices. When mule values are specified for either the price or

quantity attributes in a single PriceQuantity instance, they will be

tied by rules that enforce that they are internally consistent.

The effective date attribute is optional and will usually be specified when a single trade has multiple trade lots, to indicate when each trade lot become effective (usually on or around the date when the lot was traded). The trade itself will have an effective date, corresponding to the date when the first lot was traded and the trade opened.

The price and quantity attributes in the PriceQuantity data type

each have a metadata location which can reference a metadata address in

one of the Payout data types. The metadata address-location pair

allows for a reference to link objects without populating the address

object in persistence. This capability helps to support an agnostic

definition of the product in a trade (i.e. a product definition without

a price and quantity). However, the reference can be used to populate

values for an input into a function or for other purposes.

Measure

A measure is a basic component that is useful in the definition of price and quantity (both things that can be measured) and consists of two attributes:

value, which is defined as a number and could be a price or a quantityunit, which defines the unit in which that value is expressed

MeasureBase defines the basic structure of a measure in which both

attributes are optional. Various other data types that extend

MeasureBase can further constrain the existence of those attributes:

for instance, a Measure requires the value attribute to be present

(but unit is still optional because a measure could be unit-less).

type MeasureBase:

value number (0..1)

unit UnitType (0..1)

type Measure extends MeasureBase:

condition ValueExists:

value exists

The UnitType data type used to defined the unit attribute requires

the definition of units using one of five defined types:

type UnitType:

capacityUnit CapacityUnitEnum (0..1)

weatherUnit WeatherUnitEnum (0..1)

financialUnit FinancialUnitEnum (0..1)

currency string (0..1)

[metadata scheme]

condition UnitType:

one-of

A measure can vary over time. One often used case is a series of measures indexed by date. Such measures are all homogeneous, so the unit only needs to be represented once.

To represent this, the MeasureSchedule type extends MeasureBase with

a set of date and value pair attributes represented by the DatedValue

type. In that structure, the existing value attribute can still be

omitted but, when present, represents the schedule's initial value.

type MeasureSchedule extends MeasureBase:

datedValue DatedValue (0..*)

condition ValueExists:

value exists or datedValue exists

The price and quantity concepts for financial instruments are both

modelled as extensions of the MeasureSchedule data type, as detailed

below. This means that by default, price and quantity are considered as

schedules although they can also represent a single value when the

datedValue attribute is omitted.

Price

The PriceSchedule data type extends the MeasureSchedule data type

with the addition of the priceExpression and perUnitOf attributes,

which together further qualify the price.

type PriceSchedule extends MeasureSchedule:

perUnitOf UnitType (0..1)

priceType PriceTypeEnum (1..1)

priceSubType PriceSubTypeEnum (0..1)

priceExpression PriceExpressionEnum (0..1)

composite PriceComposite (0..1)

arithmeticOperator ArithmeticOperationEnum (0..1)

premiumType PremiumTypeEnum (0..1)

Note that the conditions for this data type are excluded from the snippet above for purposes of brevity.

The Price data type further constrains the PriceSchedule data type

by requiring the datedValue attribute to be absent.

type Price extends PriceSchedule:

condition AmountOnlyExists:

value exists and datedValue is absent

Consider the example below for the initial price of the underlying equity in a single-name Equity Swap, which is a net price of 37.44 USD per Share:

"price": [

{

"value": {

"value": 37.44,

"unit": {

"currency": {

"value": "USD"

}

},

"perUnitOf": {

"financialUnit": "SHARE"

},

"priceExpression": {

"priceType": "ASSET_PRICE",

"grossOrNet": "NET"

},

},

"meta": {

"location": [

{

"scope": "DOCUMENT",

"value": "price-1"

}

]

}

}

]

The full form of this example can be seen by ingesting one of the

samples provided in the CDM distribution under products / equity /

eqs-ex01-single-underlyer-execution-long-form-other-party.xml. As can be

seen in the full example, for an interest rate leg, the unit and the

perUnitOf would both be a currency (e.g. 0.002 USD per USD). The

priceType would be an InterestRate and, in the case of a floating leg,

the spreadType would be a Spread.

Quantity

The QuantitySchedule data type also extends the MeasureSchedule data

type with the addition of an optional multiplier attributes. It also

requires the unit attribute to exist, i.e. a quantity cannot be

unit-less. The NonNegativeQuantitySchedule data type further

constrains it by requiring that all the values are non-negative.

type QuantitySchedule extends MeasureSchedule:

multiplier Measure (0..1)

frequency Frequency (0..1)

condition Quantity_multiplier:

if multiplier exists then multiplier -> value >= 0.0

condition UnitOfAmountExists:

unit exists

type NonNegativeQuantitySchedule extends QuantitySchedule:

condition NonNegativeQuantity_value:

if value exists

then value >= 0.0

condition NonNegativeQuantity_datedValue:

if datedValue exists

then datedValue -> value all >= 0.0

The inherited attributes of value, unit and datedValue (in case

the quantity is provided as a schedule) are sufficient to define a

quantity in most cases.

The additional multiplier attribute that is provided for the

QuantitySchedule data type allows to further qualify the value. This

is needed for listed contracts or other purposes, as shown below. In

this example, the trade involves the purchase or sale of 200 contracts

of the WTI Crude Oil futures contract on the CME. Each contract

represents 1,000 barrels, therefore the total quantity of the trade is

for 200,000 barrels.

"quantity": [

{

"value": {

"value": 200,

"unit": {

"financialUnit": "CONTRACT"

},

"multiplier": {

"value": 1000,

"unit": "BBL"

}

},

"meta": {

"location": [

{

"scope": "DOCUMENT",

"value": "quantity-1"

}

]

}

}

]

The frequency attribute is used in a similar way when a quantity may

be defined based on a given time period, e.g. per hour or per day. In

this case, the quantity needs to be multiplied by the size of the

relevant period where it applies, e.g. a number of days, to get the

total quantity.

SettlementTerms

In both the Equity Swap and Interest Rate Swap trade cases mentioned above, there are no settlement terms attached to the price and quantity. Instead, any future settlement is driven by the product mechanics and the price and quantity are just parameters in the definition of that product.

In other cases, it is necessary to define settlement terms when either the price or quantity or both are to be settled. A non-exhaustive list of cases includes:

- A cash transaction, i.e. when buying a certain quantity of a security or commodity for a certain price

- An FX spot of forward transaction

- An option for which a premium must be paid

- A swap transaction that involves an upfront payment, e.g. in case of unwind or novation

In those cases, the corresponding PriceQuantity object also contains

settlementTerms and buyerSeller attributes to define that

settlement. The actual settlement amounts will use the price and

quantity agreed as part of the tradable product.

The SettlementTerms data type defines the basic characteristics of a

settlement: the settlement date, currency, whether it will be cash or

physical, and the type of transfer. For instance, a settlement could be

a delivery-versus-payment scenario for a cash security transaction or

a payment-versus-payment scenario for an FX spot or forward

transaction. Those parameters that are common across all settlement

methods are captured by the SettlementBase data type.

Cash and physical settlement methods require different, specific

parameters which are captured by the additional cashSettlementTerms

and physicalSettlementTerms attributes, respectively. For instance, a

non-deliverable FX forward will use the cashSettlementTerms attribute

to represent the parameters of the non-deliverable settlement, such as

the observable FX fixing to use.

type SettlementTerms extends SettlementBase:

cashSettlementTerms CashSettlementTerms (0..*)

physicalSettlementTerms PhysicalSettlementTerms (0..1)

type SettlementBase:

[metadata key]

settlementType SettlementTypeEnum (1..1)

transferSettlementType TransferSettlementEnum (0..1)

settlementCurrency string (0..1)

[metadata scheme]

settlementDate SettlementDate (0..1)

settlementCentre SettlementCentreEnum (0..1)

settlementProvision SettlementProvision (0..1)

standardSettlementStyle StandardSettlementStyleEnum (0..1)

BuyerSeller

When a settlement occurs for the price and/or quantity, it is necessary

to define the direction of that settlement by specifying which party

pays what. That direction is captured by the BuyerSeller data type,

that uses the normalised CounterpartyRoleEnum enumeration to specify

who is the buyer and seller, respectively.

type BuyerSeller:

buyer CounterpartyRoleEnum (1..1)

seller CounterpartyRoleEnum (1..1)

By convention, the direction of the settlement flows will be inferred as follows:

- the buyer receives the quantity / pays the price, and

- the seller receives the price / pays the quantity.

For instance in an FX spot or forward transaction, the respective units of the quantity and price will determine who is paying or receiving each currency.

Product Qualification

Product qualification is inferred from the economic terms of the

product instead of explicitly naming the product type. The CDM uses a

set of Product Qualification functions to achieve this purpose. These

functions are identified with a [qualification Product] annotation.

A Product Qualification function applies a taxonomy-specific business

logic to identify if the product attribute values, as represented by the

product's economic terms, match the specified criteria for the product

named in that taxonomy. For example, if a certain set of attributes are

populated and others are absent, then that specific product type is

inferred. The Product Qualification function name in the CDM begins with

the word Qualify followed by an underscore _ and then the product

type from the applicable taxonomy (also separated by underscores).

The CDM implements the ISDA Product Taxonomy v2.0 to qualify contractual

products, foreign exchange, and repurchase agreements. Given the

prevalence of usage of the ISDA Product Taxonomy v1.0, the equivalent

name from that taxonomy is also systematically indicated in the CDM,

using a synonym annotation displayed under the function output. An

example is provided below for the qualification of a Zero-Coupon

Fixed-Float Inflation Swap:

func Qualify_InterestRate_InflationSwap_FixedFloat_ZeroCoupon:

[qualification Product]

inputs: economicTerms EconomicTerms (1..1)

output: is_product boolean (1..1)

[synonym ISDA_Taxonomy_v2 value "InterestRate_IRSwap_Inflation"]

set is_product:

Qualify_BaseProduct_Inflation(economicTerms) = True

and Qualify_BaseProduct_CrossCurrency( economicTerms ) = False

and Qualify_SubProduct_FixedFloat(economicTerms) = True

and Qualify_Transaction_ZeroCoupon(economicTerms) = True

If all the statements above are true, then the function evaluates to True, and the product is determined to be qualified as the product type referenced by the function name.

Note: In a typical CDM model implementation, the full set of Product Qualification functions would be invoked against each instance of the product in order to determine the inferred product type. Given the product model composability, a single product instance may be qualified as more than one type: for example in an Interest Rate Swaption, both the Option and the underlying Interest Rate Swap would be qualified.

The CDM supports Product Qualification functions for Credit Derivatives,

Interest Rate Derivatives, Equity Derivatives, Foreign Exchange, Security

Lending, and

Repurchase Agreements. The full scope for Interest Rate Products has

been represented down to the full level of detail in the taxonomy. This

is shown in the example above, where the ZeroCoupon qualifying suffix

is part of the function name. Credit Default products are qualified, but

not down to the full level of detail. The ISDA Product Taxonomy v2.0

references the FpML transaction type field instead of just the product

features, whose possible values are not publicly available and hence not

positioned as a CDM enumeration.

The output of the qualification function is used to populate the

productQualifier attribute of the ProductTaxonomy object, which is

created when a NonTransferableProduct object is created. The product

taxonomy includes both the product qualification generated by the CDM

and any additional product taxonomy information which may come from the

originating document, such as FpML. In this case, taxonomy schemes may

be associated to such product taxonomy information, which are also

propagated in the ProductTaxonomy object.

Many different financial taxonomies may be used by various segments of the financial industry to describe the same product. To support a multitude of taxonomies without adding any specific identity to data types in the model, a Taxonomy type is used to identify the source and attributes any particular taxonomy structure.

type Taxonomy:

source TaxonomySourceEnum (0..1)

value TaxonomyValue (0..1)

TaxonomyValue has been expanded to represent a complex type:

type TaxonomyValue:

name string (0..1)

[metadata scheme]

classification TaxonomyClassification (0..*)

condition ValueExists:

name exists or classification exists

TaxonomyClassification is also a complex type that support a

hierarchical structure of any depth:

type TaxonomyClassification:

className string (0..1)

value string (1..1)

description string (0..1)

ordinal int (0..1)

The ProductTaxonomy data structure and an instance of a CDM object

(serialised into JSON) are shown below:

type ProductTaxonomy extends Taxonomy:

primaryAssetClass AssetClassEnum (0..1)

[metadata scheme]

secondaryAssetClass AssetClassEnum (0..*)

[metadata scheme]

productQualifier string (0..1)

condition TaxonomyType:

required choice source, primaryAssetClass, secondaryAssetClass

condition TaxonomySource:

if source exists then ( value exists or productQualifier exists )

condition TaxonomyValue:

optional choice value, productQualifier

"productTaxonomy": [

{

"primaryAssetClass": {

"meta": {

"scheme": "http://www.fpml.org/coding-scheme/asset-class-simple"

},

"value": "INTEREST_RATE"

},

},

{

"taxonomyValue": {

"meta": {

"scheme": "http://www.fpml.org/coding-scheme/product-taxonomy"

},

"value": "InterestRate:IRSwap:FixedFloat"

}

"taxonomySource": "ISDA"

},

{

"productQualifier": "InterestRate_IRSwap_FixedFloat",

"taxonomySource": "ISDA"

}

]